Bank shuts down money transfer business

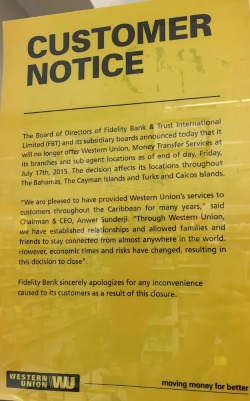

(CNS Business): Fidelity Bank leaders said that due to “economic times and risks” they have officially closed the doors to their money transfer service, Western Union, throughout the Cayman Islands. The Board of Directors of Fidelity Bank & Trust International Limited (FBT) and its subsidiary boards have announced that they will no longer offer Western Union at its branches and sub-agent locations.

(CNS Business): Fidelity Bank leaders said that due to “economic times and risks” they have officially closed the doors to their money transfer service, Western Union, throughout the Cayman Islands. The Board of Directors of Fidelity Bank & Trust International Limited (FBT) and its subsidiary boards have announced that they will no longer offer Western Union at its branches and sub-agent locations.

In a press release Monday the bank apologised for the “inconvenience” of the sudden and unexpected closure for customers last Friday, as it confirmed that its nine money transfer locations for Western Union across Grand Cayman were all now closed. Chairman and CEO Anwer Sunderji said that while the bank had provided the Western Union service for many years, times had changed, resulting in the decision.

“It is a difficult time for the money transmission business as correspondent banks are increasingly wary of dealing with institutions participating in this segment,” the head of the Bahamas-based bank said. “The Bank has been subjected to higher bank fees in various jurisdictions to process the receipts of its money transfer business. Coupled with declining margins and increasing compliance costs, the directors deemed it prudent to de-risk and exit this business.”

The former UDP administration imposed a 2% transaction fee for every CI$100 transferred, starting from January 2010, which cut into the local business. Meanwhile, many local banks have come under pressure from their partner banks in the US to stop their cash transfer services due to the potential for money laundering.

With a high number of overseas workers in Cayman remitting money back to their home countries, and in particular Jamaica, the business represented over 600,000 annual transactions from here in 2014, according to CIMA, with almost $180 million sent overseas last year.

This decision also affects other Western Union locations throughout the Bahamas and the Turks and Caicos Islands, officials added.

Category: Finance, Financial Services, Local Business

It may just be a pure coincidence, but wasn’t Western Union one of Jeff Webbs babies , when he was at Fidelity?

Jeffrey Webb, the former FIFA and CONCACAF official now facing corruption charges in the United States, worked as Western Union’s local agent.

Wasn’t Jeff Webb in charge of this? Is this a coincidence or something more interesting?

To shut down the business in such a sudden manner is very suspect particularly as the are under scrutiny for Webb transactions. Hope this isn’t all that is needed to sweep things under the rug.

Not mentioned here, and only mentioned on page 7 of the Compass report is that Jeffrey Webb, the former FIFA and CONCACAF official now facing corruption charges in the United States, worked as Western Union’s local agent.

Did this have any bearing on this sudden outcome?

One would have to be a complete simpleton not to consider the possibility.

Truthseeker

I have never utilised their services, but I know this has closure has affected several of my staff. I always questioned prudence of the high fee increase for small transfers as it impacts those least able to pay, ie lower income workers.